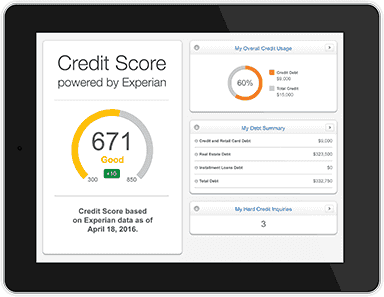

See your completely FREE Experian Credit Report & FICO® Score*.

No credit card required.

Checking your own score doesn't hurt your credit.

Get Your Report & FICO Score*Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more.

Why Monitor My Credit

Get automatic email alerts when a new account is opened in your name

Look for red flags that could be indicators of fraudulent activity or identity theft

Your FICO® Score Matters

Good Score

Pay Bills On Time

Low Credit Card Balances

Age of Accounts

Poor Score

Late or Missed Payments

Too Many Credit Requests

Foreclosures

Included With Your FICO® Score

Your Experian Credit Report & FICO Score are refreshed every 30 days on sign in

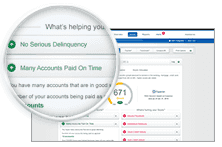

Look for inaccuracies that could be hurting your FICO Score

Have questions about your FICO Score? Our people are waiting to help 7 days per week